Shares in CATL surged 14.5% to RMB 180.85 ($25.2) on Hannah Harper ArchivesMonday after Morgan Stanley lifted its rating on the stock to Buy from Hold and forecast the Chinese electric vehicle battery maker to return to strong profit growth in the coming months this year. The analysts raised CATL’s price target from RMB 184 to RMB 210, saying a brutal competitive battle in battery prices will end in 2024, which could weigh on its profit in the first quarter but result in a strong recovery later on. The news also comes after CATL regained its top ranking in the affordable lithium iron phosphate (LFP) battery category with a market share of 41.8% at home from January to February, followed by BYD’s 29.8%, figures from the China Automobile Battery Innovation Alliance showed. The battery giant in January forecast net profit to grow by up to 48.1% to RMB 45.5 billion in 2023, a slowdown from 92.9% a year prior and 185.3% in 2021. [Caixin, in Chinese]

(Editor: {typename type="name"/})

Weather app glitch makes it look like hell is basically freezing over

Weather app glitch makes it look like hell is basically freezing over

Bad Genre: Annie Ernaux, Autofiction, and Finding a Voice by Lauren Elkin

Bad Genre: Annie Ernaux, Autofiction, and Finding a Voice by Lauren Elkin

Uwe Johnson: Not This But That by Damion Searls

Uwe Johnson: Not This But That by Damion Searls

The Taste of Dawn

The Taste of Dawn

Shop the iPad Air and iPad 11th generation for their lowest

Shop the iPad Air and iPad 11th generation for their lowest

Shop Owala's Memorial Day Sale for 30% off tumblers

SAVE 30%:This Memorial Day, shop Owala's tumblers for 30% off. Get a 40 oz. tumbler for just $28 and

...[Details]

SAVE 30%:This Memorial Day, shop Owala's tumblers for 30% off. Get a 40 oz. tumbler for just $28 and

...[Details]

New Morals for Aesop’s FablesBy Anthony MadridNovember 7, 2018Arts & CultureIllustration from a

...[Details]

New Morals for Aesop’s FablesBy Anthony MadridNovember 7, 2018Arts & CultureIllustration from a

...[Details]

The Erotics of Cy Twombly by Catherine Lacey

The Erotics of Cy TwomblyBy Catherine LaceyOctober 17, 2018Arts & CultureCy Twombly in Grottafer

...[Details]

The Erotics of Cy TwomblyBy Catherine LaceyOctober 17, 2018Arts & CultureCy Twombly in Grottafer

...[Details]

Staff Picks: Potters, Porridge Bowls, and Pastries as Existential Truths by The Paris Review

Staff Picks: Potters, Porridge Bowls, and Pastries as Existential TruthsBy The Paris ReviewOctober 1

...[Details]

Staff Picks: Potters, Porridge Bowls, and Pastries as Existential TruthsBy The Paris ReviewOctober 1

...[Details]

Best Fire Stick deal: Save $20 on Amazon Fire Stick 4K

SAVE $20: As of April 8, the Amazon Fire Stick 4K is on sale at Amazon for $29.99. That's a 40% disc

...[Details]

SAVE $20: As of April 8, the Amazon Fire Stick 4K is on sale at Amazon for $29.99. That's a 40% disc

...[Details]

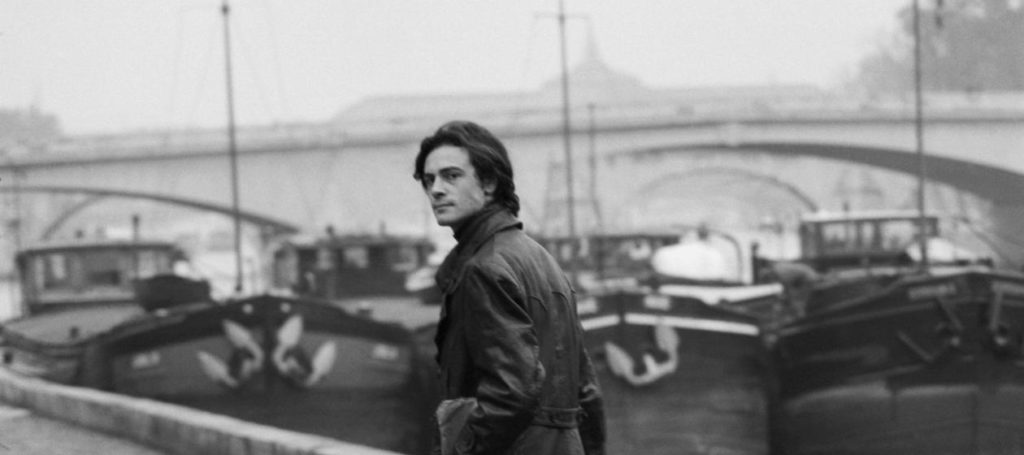

Bring Back Cortázar by Alejandro Zambra

Bring Back CortázarBy Alejandro ZambraOctober 17, 2018Arts & CultureArgentine writer Julio Cortá

...[Details]

Bring Back CortázarBy Alejandro ZambraOctober 17, 2018Arts & CultureArgentine writer Julio Cortá

...[Details]

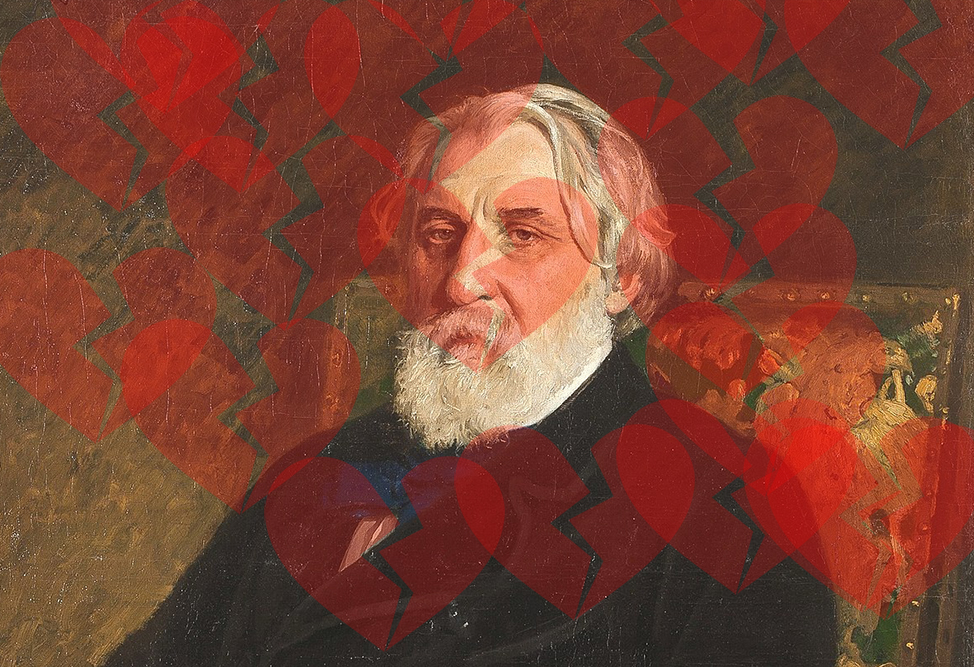

Surviving Unrequited Love with Ivan Turgenev by Viv Groskop

Surviving Unrequited Love with Ivan TurgenevBy Viv GroskopOctober 19, 2018Arts & CultureI found

...[Details]

Surviving Unrequited Love with Ivan TurgenevBy Viv GroskopOctober 19, 2018Arts & CultureI found

...[Details]

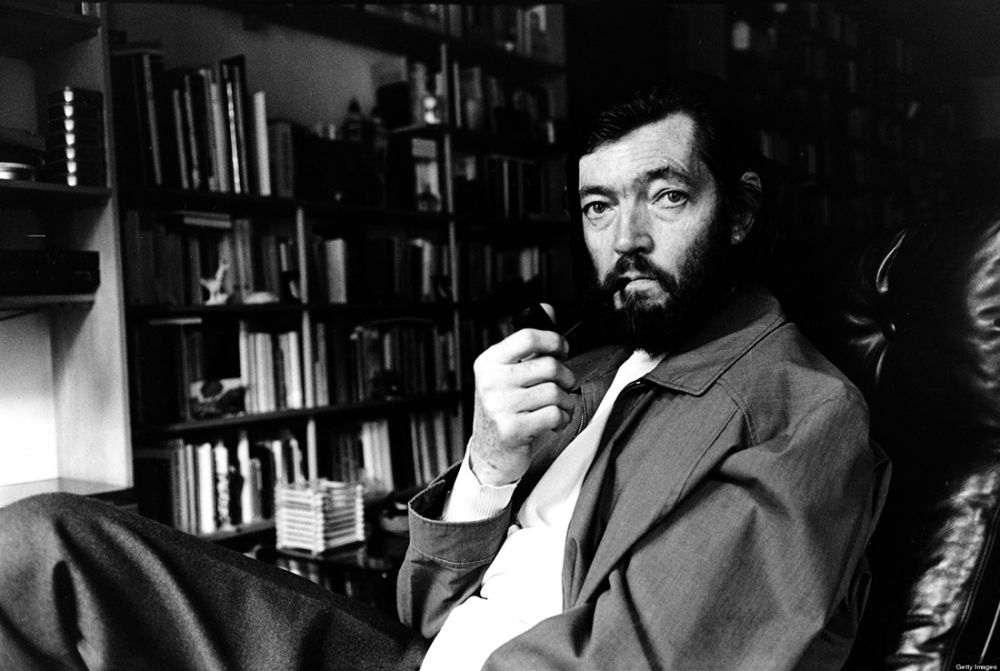

Simply ImpossibleBy Mark PolizzottiOctober 22, 2018Arts & CulturePatrick ModianoTranslation lore

...[Details]

Simply ImpossibleBy Mark PolizzottiOctober 22, 2018Arts & CulturePatrick ModianoTranslation lore

...[Details]

Toward a More Radical Selfie by India Ennenga

Toward a More Radical SelfieBy India EnnengaNovember 27, 2018Arts & CultureMitchell Grafton, Upd

...[Details]

Toward a More Radical SelfieBy India EnnengaNovember 27, 2018Arts & CultureMitchell Grafton, Upd

...[Details]

接受PR>=1、BR>=1,流量相当,内容相关类链接。